Let’s talk fertilityinsurance coverage

We’re here to help you understand your coverage, explore available insurance options, and discover financial support solutions so you can plan your fertility journey with ease.

We’re here to help you understand your coverage, explore available insurance options, and discover financial support solutions so you can plan your fertility journey with ease.

Costs can vary based on location, whether you’re using your own egg and sperm or not, and several other factors.

Use our finder tool to view different clinics.

Plus, get tips on how to work with your doctor.

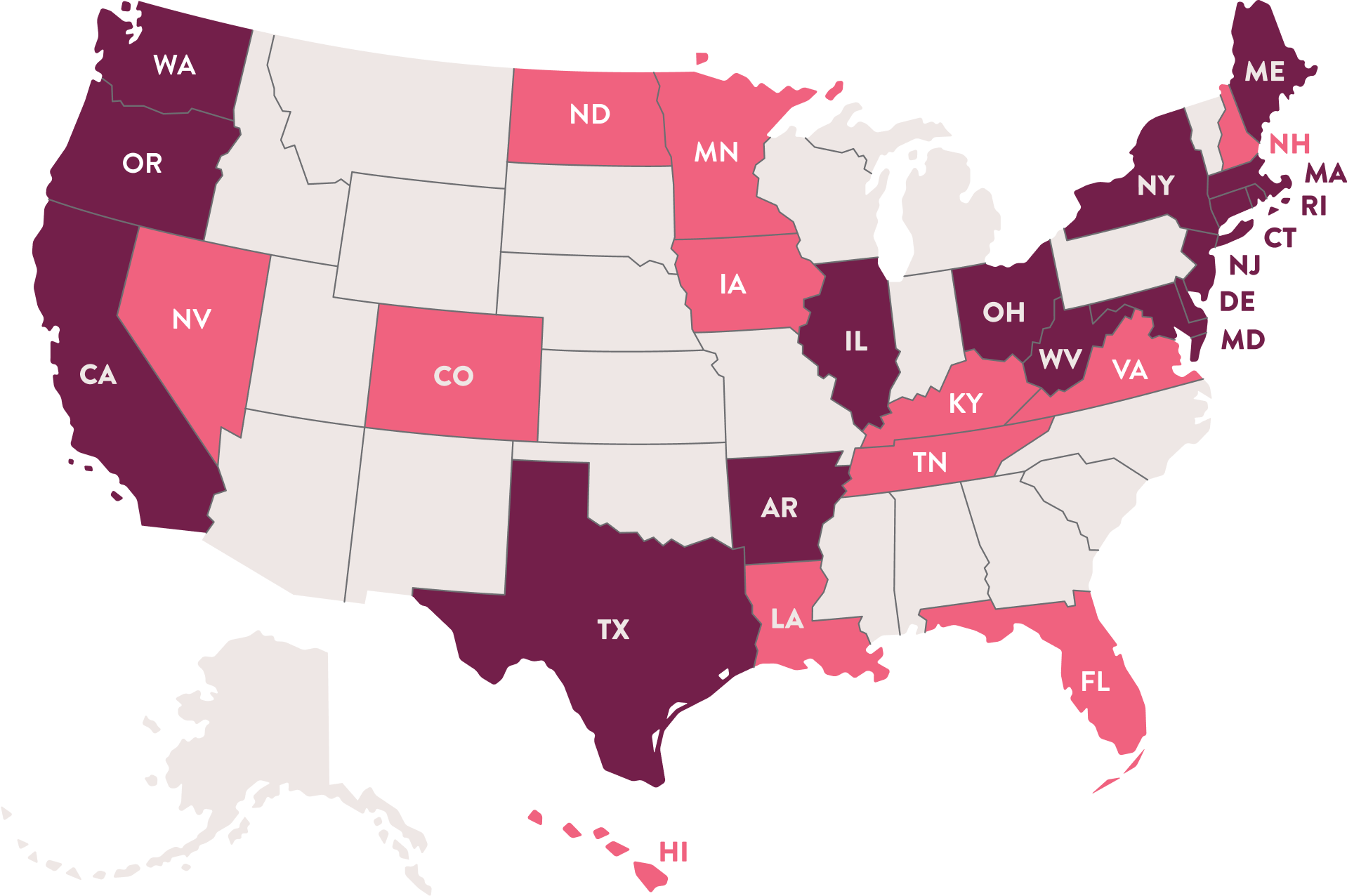

Do you live in a state with mandate to cover or mandate to offer?

If YES, some or all insurance providers are required to offer insurance benefits for fertility treatments.

Mandate to cover means that some or all insurance plans have to cover certain

fertility treatments

Mandate to offer means that while insurance providers have to offer certain testing and treatment services, employers can decide which of those benefits, if any, to offer to people covered by their plan

Generally, the state where your employer is located determines whether or not the state mandate applies to your employer-provided health insurance plan.

Talk to your benefits provider to find out what services are covered for you

Ask your employer: What’s covered under my plan? What benefits do I have? How can I add benefits?

Check out the list of terms and phrases we put together to help you speak insurance lingo.

For more information around insurance coverage, check out RESOLVE.org

56 Liberty St Schenectady, NY, 12345

0 miles

56 Liberty St Schenectady, NY, 12345

0 miles

56 Liberty St Schenectady, NY, 12345

0 miles

56 Liberty St Schenectady, NY, 12345

0 miles

56 Liberty St Schenectady, NY, 12345

0 miles

56 Liberty St Schenectady, NY, 12345

0 miles

This is not a complete list of all physicians in your area. Ferring is not responsible for the consistency and accuracy of the information provided. A listing on this site does not constitute a referral, recommendation, or endorsement for any physician or practice listed.

Ferring does not have responsibility for, or control of, the contents, availability, operation, or performance of other websites to which this website may be linked or from which this website may be accessed. Ferring makes no representation regarding the content of any other websites that you may access from this website.